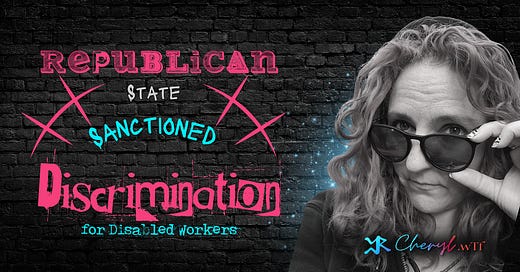

Republican State Sanctioned Discrimination for Disabled Workers

AKA The ABLE Employment Flexibility Act of 2024

🤯 Cheryl.wTf 🍴 | 🔔 Subscribe | | 📖 Shop Books | 👕 Shop Merch

Keep reading with a 7-day free trial

Subscribe to Disruption Radio with Cheryl.wTf to keep reading this post and get 7 days of free access to the full post archives.